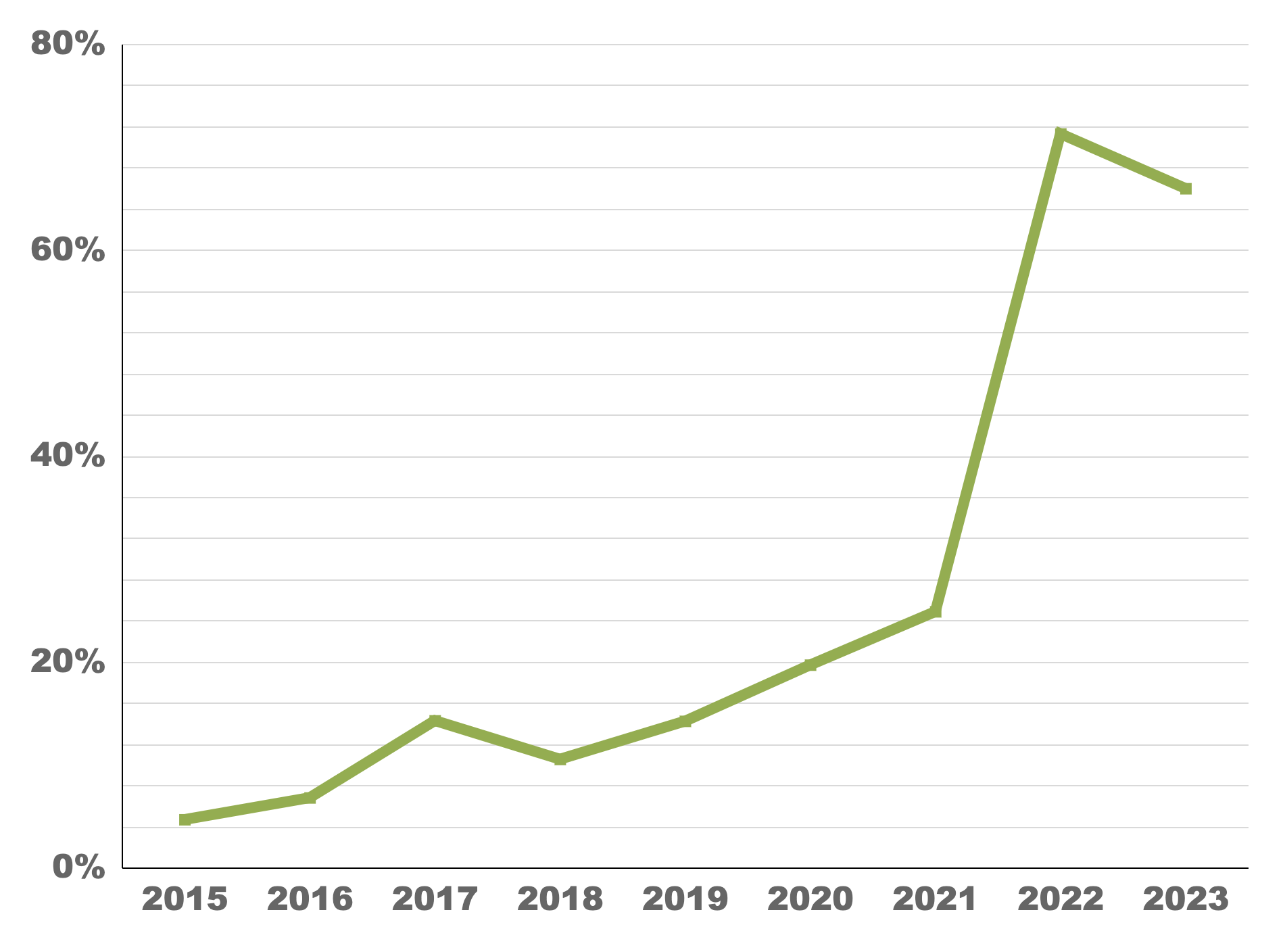

Annualized ROI 21% - Invests in under-performing multi-family assets. Increases value and cash flow, keeps assets in perpetuity.

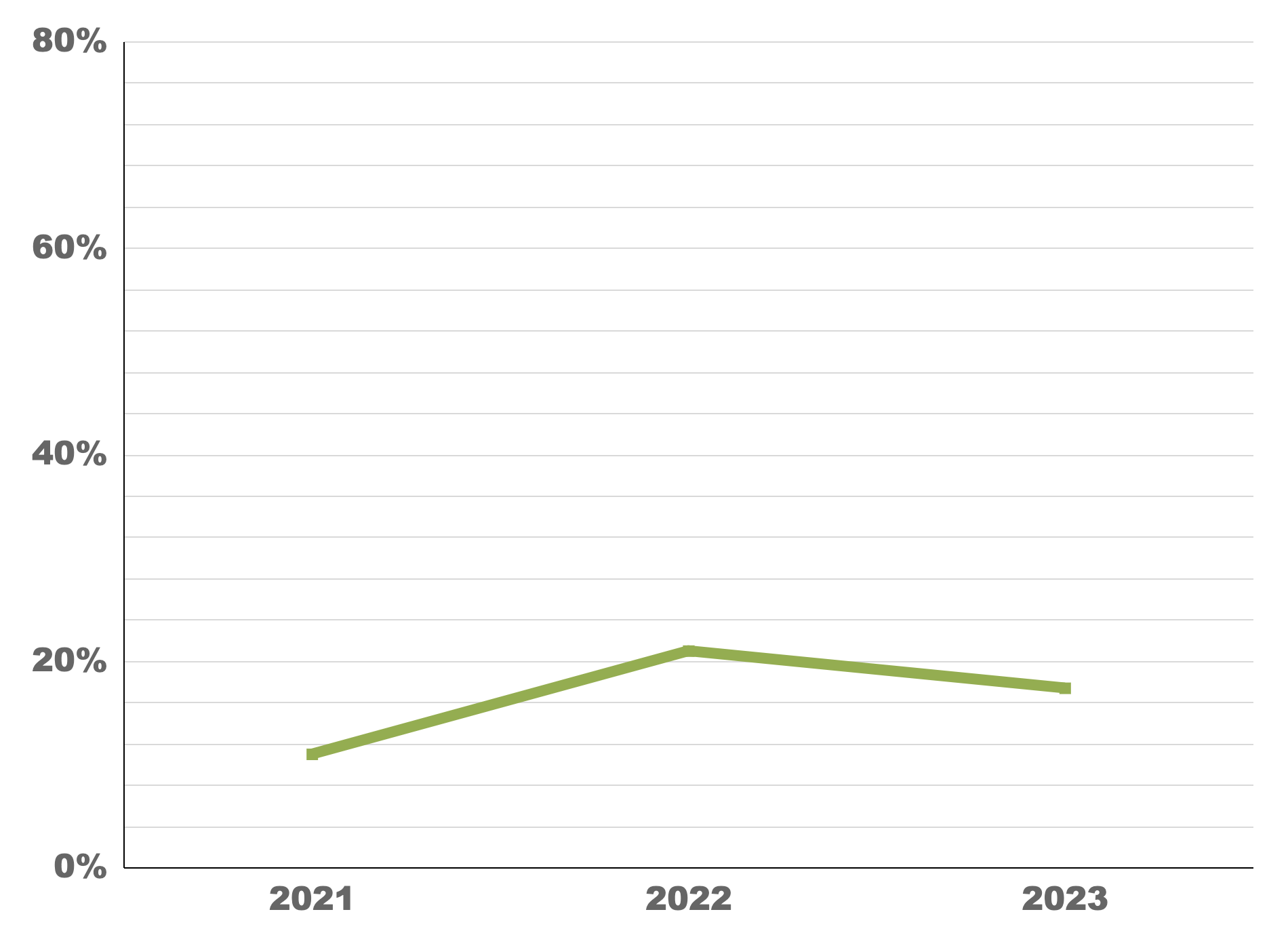

Annualized ROI 16% - Invests in real estate assets that are in need of work. Renovates and leases assets for cash flow or sells them at a profit.

Minimum Join

Preferred Rate

Total Raise

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our minimum investment varies from fund to fund.

Yes. All of our real estate opportunities are for Accredited Investors only due to the level of risk associated with the illiquidity. An Accredited Investor can qualify either by income level, net-worth level or by both.

See https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor for more info.

Each fund is structured as an individual Florida entity (LLC). An investor in the fund is considered a limited partner. Each partner owns a percentage of the entity in proportion to their investment. The fund is managed by the General Partner, TG Capital Management.

Yes. The MP’s invest their capital in some or all of the funds.

All risks as an investor are limited to the cash invested. The fund is structured so no personal liability can be passed onto an investor.

TG CAPITAL MANAGEMENT

6817 Southpoint Pkwy Suite 2304

Jacksonville, FL 32216

Copyright 2024, TG Capital Management, LLC